Hey, Abe! Is Per Diem Different for Owner-Operators and Company Drivers?

Yes, per diem works very differently depending on whether you’re an owner-operator (independent contractor) or a company driver (W-2 employee). Understanding this distinction is critical, [...]

How to Plan for Retirement as a Truck Driver: Tax-Advantaged Options

As a truck driver, saving for retirement can feel challenging, especially if you're self-employed or an independent contractor. However, there are several tax-advantaged retirement accounts [...]

Hey, Abe! Should I buy new equipment before December 31 to lower my taxes?

It’s a common question for truck drivers, and the answer depends on your situation. Purchasing equipment before year-end can offer a tax benefit, especially if [...]

Managing Holiday Spending on the Road: Financial Tips for Truck Drivers

The holiday season can be one of the most exciting and most expensive times of the year. Gifts, travel, special meals, and year-end events can [...]

Turkey, Taxes, and Timing: What Truck Drivers Should Know About Year-End Tax Planning

Between long hauls, tight schedules, and holiday deliveries, the holidays can sneak up fast. But before you shift into full Thanksgiving mode, wherever the road [...]

Hey, Abe! What’s the best way to know how much I’ll owe in taxes before the year ends?

Great question, and you’re not alone. Many people wonder where they stand taxwise as the year wraps up, especially if their income has changed or [...]

Hey, Abe! Do I need to report cash jobs, like helping at a pumpkin patch or seasonal delivery route?

Great question. Cash jobs, like helping at a pumpkin patch or running a seasonal delivery route, can seem informal, but the IRS still considers this [...]

Seasonal Work and Taxes: How Short-Term Driving Jobs Affect Your Return

Fall is one of the busiest seasons in the transportation industry. From hauling grain during harvest to keeping shelves stocked for the holiday rush, seasonal [...]

Why Fall Is the Perfect Time to Clean Up Receipts and Logs

On the road, staying organized isn’t just about keeping your cab tidy. It’s about keeping your records ready. When tax season hits, the drivers who [...]

Hey, Abe! What records do I need to keep to claim per diem?

Great question. Per diem is one of the most valuable deductions available to truck drivers, but it is also one of the most misunderstood. Per [...]

I heard the per diem rate is changing for 2025, is that true?

You heard right—per diem is going up in 2025! Starting in the 2025 tax year, the Department of Transportation per diem rate for meals and [...]

College Costs and Tax Breaks: A Roadmap for Drivers with Kids in School

Life on the road means managing time, deliveries, and deadlines. But when your child heads off to college, a new set of logistics kicks in. [...]

One Big Beautiful Bill Signed Into Law

Tips to Take Advantage of the Bill This Article is an Update From Previous Guidance: https://abacuspro.com/10-ways-the-proposed-new-tax-cuts-could-affect-your-taxes-this-year/ The "One Big Beautiful Bill Act" (OBBBA) is a [...]

Do I need to report child support payments on my tax return?

Great question, and one that trips up a lot of people. Let’s break it down. If you’re making child support payments, those payments are not [...]

What Happens If You Don’t Pay Your Quarterly Estimated Payments

If you own a business, managing taxes can be difficult. The 2025 deadlines for 1st and 2nd quarter were April 15, 2025 and June 16, [...]

Do I have to file with my quarterly estimated payments?

Hey Abe! I am a lease operator, and I know that I’m required to pay my taxes in quarterly estimates. Do I have to file [...]

A Tax Deduction You Might Be Missing As a Self-Employed Individual

If you’re self-employed, there’s a valuable tax deduction that you might be overlooking: the self-employed health insurance deduction. This allows you deduct the cost of [...]

What if I need to file an extension this year?

Great question! Filing a tax extension refers to a process by which taxpayers can request additional time beyond the original tax filing deadline to submit [...]

Tax Penalties & Interest After the April Deadline

As we move past the April 15 deadline, it's crucial for individual taxpayers to understand the potential penalties and interest that may accrue if taxes [...]

Understanding Quarterly Taxes

What are estimated tax payments? Estimated tax payments are required for individuals who expect to owe at least $1,000 in tax after subtracting tax withholding [...]

Do I have to file for paying my co-driver $1,200?

Hey Abe! I am a lease/owner operator, and I paid my co-driver $1,200 in 2024. Do I have to file anything for this? Great question! [...]

Tax Season 2025: Are You Ready to File Your 2024 Taxes?

As Tax Season 2025 quickly approaches, it’s time to get organized and prepared to file your 2024 taxes. Over the years, we’ve noticed that taxpayers [...]

BOI Filing Update: What You Need to Know and How to Prepare

This article is an update from a previously published article about BOI Reporting. As we approach the original January 1, 2025, deadline for Beneficial Ownership [...]

Why Fall is the Perfect Time for Tax Planning

With the fall tax deadlines behind us, it’s tempting to take a well-deserved break from all things tax-related. However, taking a proactive approach now, in [...]

What do I need to know about BOI Reporting?

As of January 1, 2024, businesses must report Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN). This requirement applies to all businesses. [...]

The Importance of Budgeting in Times of Rising Cost and Inflation

In today’s economic landscape, the rising costs of goods and services are becoming increasingly difficult to ignore. With inflation rates fluctuating, it’s crucial for individuals [...]

What can I do to prepare for the back-to-school season?

Hi Abe! What can I do to prepare for the back-to-school season? Great question. The back-to-school season is an exciting time, but it can also [...]

Tax Planning for Families with College Students

As a driver, you’re used to navigating long hauls and managing your time on the road. But when it comes to your finances, especially with [...]

What are the tax implications of gambling?

Great question. If you purchase a lottery ticket or gamble at a casino and win big, you need to be prepared for potential tax implications. [...]

IRS Tax Notices 2024

Why you may have received a notice from the IRS With the April deadline behind us and 2023 tax returns being processed by the IRS, [...]

10 Summertime Tax Facts

Do you know these tax facts? As you enjoy the mid-June sunshine, take a moment to brush up on some important tax facts. In this [...]

Considering a Second Business under your LLC

Hey Abe! Can I run a second business under my trucking LLC? Abe: Oooh, Thanks for asking this one. The answer to this question is [...]

Penalties & Interest After the April 15 Deadline

As we move past last month's deadline, it's crucial for individual taxpayers to understand the potential penalties and interest that may accrue if taxes remain [...]

What if I need to file an extension?

Great question! Filing a tax extension refers to a process by which taxpayers can request additional time beyond the original tax filing deadline to submit [...]

Where do I need to start with expenses?

Hey, Abe! I have been gathering my expenses for the upcoming tax year, but I am unsure that I’ve included everything. Where do I need [...]

Electronically Signing Your Tax Return: How Does It Work?

After your tax return is prepared, a member of the Abacus team will reach out to discuss the results. Expect an encrypted email with a [...]

How do I know which filing status to select?

Hey Abe! I'm getting ready for this upcoming tax season. How do I know which filing status to select? Great question! I’m glad you’re starting [...]

Claiming Dependents on Your Tax Return

While every American who earns an income has to pay taxes, many taxpayers can reduce how much tax they owe by claiming deductions and credits. [...]

Planning for Large Purchases

When it comes to saving for purchases, whether it's a vehicle, a house, or something of large value, there are several factors you need to [...]

Navigating Tax Implications for Trucking Investments

Investing in an Over the Road (OTR) Truck, Trailer, or Auxiliary Power Unit (APU) represents a significant financial commitment for truck drivers. Understanding how [...]

What records do I need to keep for purchasing assets?

Hey Abe! I’m considering purchasing some assets for my business, such as a tractor and maybe a trailer to go with it. What kind of [...]

BOI Reporting: What You Need to Know

Beneficial Ownership Information reporting is new in 2024 Changes are underway for business owners. As of January 1, 2024, certain business owners will need to [...]

Scam alert: FinCEN BOI Reporting

Beware of fraudulent messages about BOI reporting The U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) reported fraudulent attempts aimed at gathering [...]

Preparing for the 2023 Tax Season

Hey Abe! I am a lease/owner operator and I'm planning ahead for the 2023 tax season. I will receive a 1099-NEC, but I also have [...]

Fall is the best time to prepare for tax season

With all of the tax work finally finished for the year- whether that was the original spring deadline or just recently completed in mid-October- individuals, [...]

Who Can I Claim As a Dependent?

Hi Abe! Who can I claim as a dependent? Great question! In the United States, a dependent is generally an individual who relies on someone [...]

How Much Do Kids Cost?

Whether you are planning to start a family or have children and want to reevaluate your spending, it’s important to plan for the expenses of [...]

Pretax vs. After-Tax Contributions

Let's talk about retirement savings without all the confusing financial jargon. You've probably heard about pre-tax and after-tax contributions, but what do they really mean [...]

What Expenses Can I Deduct?

In the world of accounting, a question that frequently crosses the minds of business owners is: ”What expenses can I deduct?” This question is entirely [...]

Saving Receipts? What You Should Do

Hi Abe! I have a TON of receipts on the truck I am keeping as an independent contractor. What are the IRS rules regarding keeping [...]

Feeling Lucky? What You Need to Know Before You Gamble

Do you feel lucky? Have you ever purchased a lottery ticket, scratch off, or gambled in a casino? Many Americans have. According to the National [...]

Saving for Quarterly Taxes

Hi Abe, How much should I be saving for my quarterly taxes? I’m glad you’re thinking ahead! It’s recommended for independent contractors to save between [...]

IRS Tax Notices

Why You May Have Received a Letter From the IRS We have noticed an influx of clients receiving tax notices now that the April deadline [...]

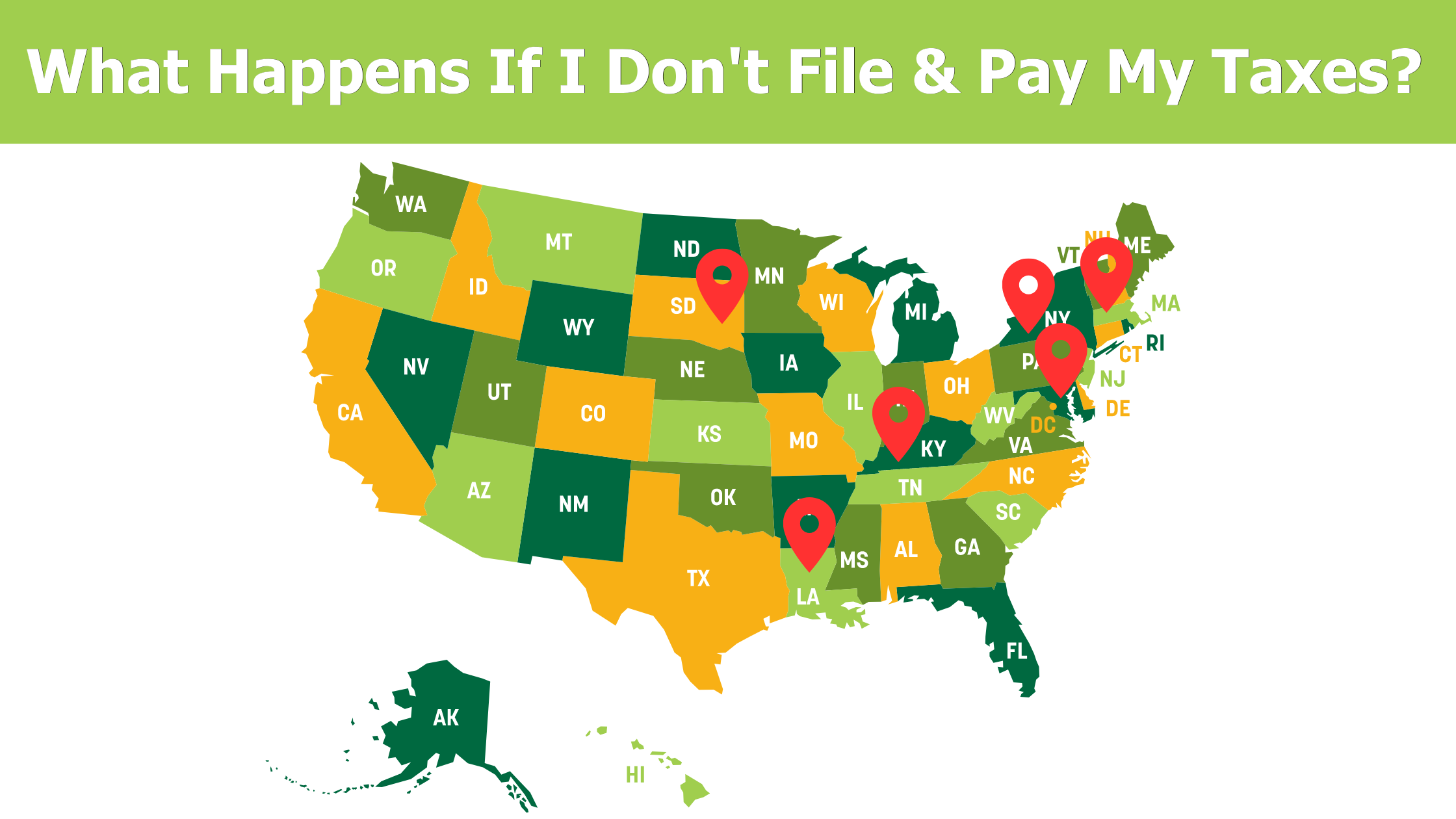

What Happens If I Don’t File & Pay My Taxes?

Preserve your right to work! What states can do to prevent you from driving. If you owe and do not file your taxes, the IRS [...]

Penalties & Interest After April 18

Now that the April 18th tax deadline has passed, individual taxpayers need to understand the penalties and interest that can accrue if the tax amount [...]

How Do I Track My Expenses?

Hey, Abe! I have been gathering my expenses for the upcoming tax year, but I am getting all turned around when I try to ensure [...]

What if I miss the tax-filing deadline?

Hey, Abe! Things have been pretty busy with my business, and it’s looking like I may not be able to file in time. Should I [...]

Social Security Taxability

Every year, Abacus CPAs serves people that are in retirement, and every year, some still have to pay taxes on their Social Security benefits. Not [...]

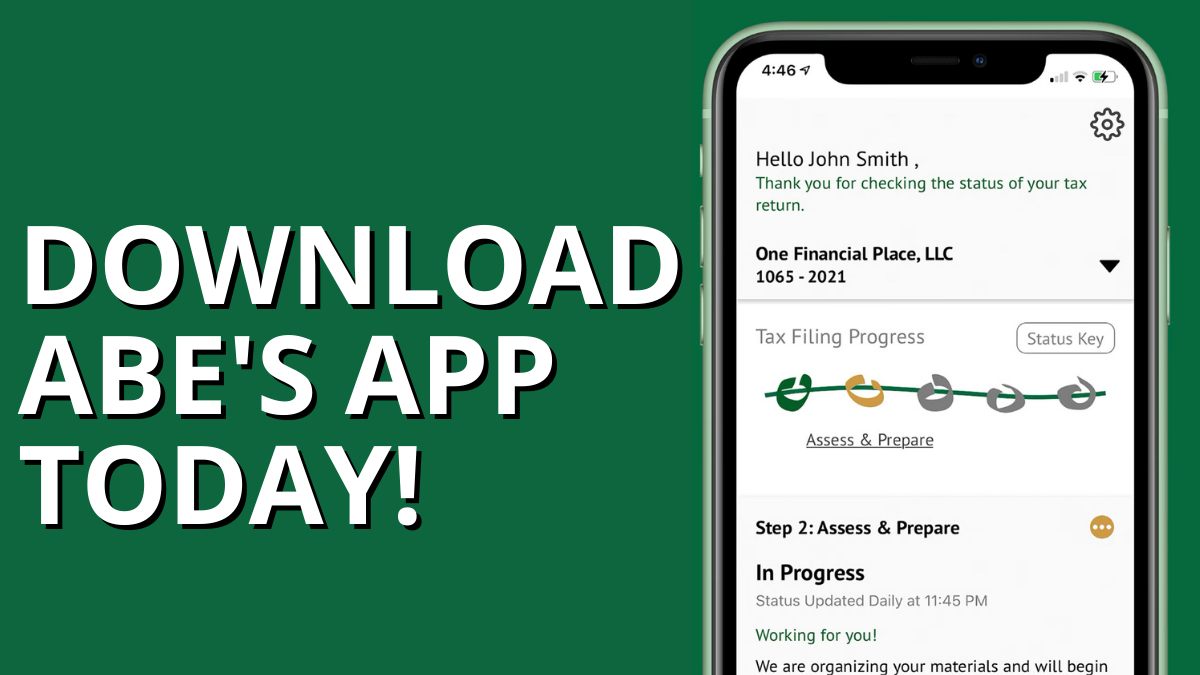

Download the Abacus App Today!

The Abacus App allows you to follow your tax return from start-to-finish while its with Abacus Professionals. You can upload documents, track tax project progress, [...]

How do I plan my final contributions for 2022?

Abe, I am planning out my final contributions for 2022 with my IRA. How long do I have to submit that for the tax year [...]

Is filing taxes really that important?

Hi Abe! I own a trucking business and taxes are the last thing I want to worry about each year. It is tough to find [...]

Maximize Your Tax Savings

Hi Abe! I am wanting to maximize my tax savings and ensure I am taking full advantage of breaks for business owners and those [...]

Preparing for the 2022 Tax Season as a Lease/Owner Operator

Hey Abe! I am a lease/owner operator and I'm planning ahead for the 2022 tax season. I will receive a 1099-NEC, but I also have [...]

What Loans Look Like for Self-Employed Individuals

Are you considering upgrading your truck? What about remodeling your home, or even buying a new home? These are big financial decisions that will [...]

LLC Corner: Options for Terminating Your Contract Company

I have termed my current contract company. What does this mean for my LLC? An LLC belongs to the owner(s) of the business, not the [...]

Why You May Have Received an IRS Tax Notice Letter

Receiving a letter from the Internal Revenue Service (IRS) can be intimidating and can lead to many questions. The most common tax notices we [...]

Form 2290 Heavy Highway Use Tax: The Who, When, What & How

Who is required to file? Anyone who registers a heavy highway motor vehicle in their name with a taxable gross weight of 55,000 pounds [...]

Eco-Friendly Trucking: Save Money and Reduce Your Carbon Footprint

Growing your business and stewarding the environment both require good resource management. In both areas, you need to grow your resources, reduce waste, and [...]

Child Tax Credit

What You Need to Know About Dependents: Child Tax Credit If you have a qualifying dependent that qualifies for child tax credit on your 2021 [...]

Quarterly Estimate Payments

It's a new year and a new you! You've likely set personal resolutions, but have you set resolutions for your business? Your Business New Year [...]

Is an S-Corporation Right For You?

It will be New Year’s day before we know it. You might already be thinking about New Year’s Resolutions. If you’re a business owner this [...]

Money Management to Make the Most of Your Funds

Becoming a small business owner requires next-level money management. Here are a few ideas to make it easier for you: Keep your Eyes on the [...]

Received an IRS Letter? What It Means & What You Should Do

Receiving a letter from the Internal Revenue Service (IRS) can be intimidating and can lead to many questions, such as: What to do when you [...]

Claiming Dependents on Your Individual Income Tax Return

Year after year, we get questions on who can be claimed as a dependent on an income tax return. For some taxpayers, the answer is [...]

Organizing on the Road

Being a small business means keeping on top of a lot of details. It’s easy to get overwhelmed and fall behind. Here are some ideas [...]

LLCs & Filing, Paying Business Taxes

Hi Abe! I am getting ready to sign a contract to act as a lease operator under a Limited Liability Company (LLC). Will I have [...]

The 2021 Child Tax Credit: Should you accept or decline?

For 2021 only the child tax credit has been increased from $2,000 per child to $3,000 per child from ages 6-17 and $3,600 per child [...]

Strategies for Successful Customer Service Calls

At some point, you may need to speak with a Client Service Representative. You could have a question, need to resolve an issue, or need [...]

Wellness on the Open Road

Planning and mapping out a 10-hour drive is something that I have enjoyed doing on more than a few occasions in my life. This type [...]

Considering an Upgrade? What Loans Look Like for the Self-Employed

Over this last year, I’ve heard the term the ”new” normal over and over because life during this pandemic has been ”odd.” I am happy [...]

Tax Return Changes (that can keep you busy)

The birds are chirping, the flowers are blooming and Tax Deadline is fast approaching. This tax year much like last has been a challenge for [...]

When You Don’t Have Enough $$ for Quarterly Estimates

Hey Abe! I recently received my quarterly estimate for Abacus, but did not have the full amount of money recommended to pay in. What should [...]

Abe Answers: Moving Across State Lines

Hi Abe! My family and I are moving across state lines this year? What changes could this mean to my taxes as a self-employed person? [...]

Home Office Deductions

Self-employed individuals can use a portion of their home in order to conduct business as a home office. Whether you rent or own your home, [...]

Community Property States

Community property laws affect how you figure your income on your federal income tax return if you are married, live in a community property state [...]

What’s My Filing Status?

Choosing the correct filing status is critical in the preparation of your tax return, because it determines what tax bracket you fall in and how [...]

Abe Answers: What is Abacus Access?

Q: Abe! I was recently filling out my tax organizer and I saw that I can receive a copy of my tax return with something [...]

Abe Answers: Leasing vs. Owning a Truck

Q: Abe! I was wondering if I should lease a truck or try to purchase one outright. What are some of the differences that I [...]

Own It! Success in Your Business

Running your business well is great, but to truly OWN IT and recognize what that means will be the difference between just getting by year [...]

Tax Changes that May Impact You in 2021

WOW! What a year 2020 was. I don’t know about you, but I am ready for a fresh start this New Year. 2020 had its [...]

Filing Tax Organizers Every Year

Q: What is a tax organizer and why do I have to fill out a tax organizer for every year I file? Abe: The Tax [...]

Professional Reputations & Bad Customer Experiences

We have all had a disappointing experience with a business before, and with the internet and social media these days it is easier than ever [...]

What Counts as a Business Deduction?

Hey Abe! What counts as a deduction for my business? Abe: The guidelines to remember with business expenses are that they must be ordinary and [...]

How to Pay Quarterly Estimate and Balance Dues on Returns

Over the course of the year, one of the most proactive decisions you can make as an independent contractor is to pay your quarterly estimates. [...]

How much to save for Quarterly Taxes?

Hi Abe, How much should I be saving for my quarterly taxes? Abe: I am glad you asked this important question. It is often recommended [...]

Abacus Problem Resolution Team: Helping with IRS issues

You may not know the feeling of getting a letter in the mail from the IRS. It can cause you to worry and assume the [...]

Quarterly Tax Payments: Personal vs. Business

Hi Abe! I recently tried making a quarterly tax payment and was informed that I needed to make my payment as a personal tax payment [...]

Presenting Your Best Self

An entrepreneur/business person is a person who sets up a business. The term "businessperson" may refer to a founder, owner, or majority shareholder of a [...]

What COVID-19 means for your IRS Payments

You know when you go on vacation or are over the road for extended periods, and you come home, and the mailbox is SO full [...]

Cryptocurrency and your Taxes

Have you heard of cryptocurrency? Chances are you have come across the term before, but have you ever wondered what cryptocurrency is and how it’s [...]

Rental Properties: An Investment, Consistent Source of Income

Rental properties can be a great way to provide a consistent source of income. An investment in a rental property can provide you with monthly [...]