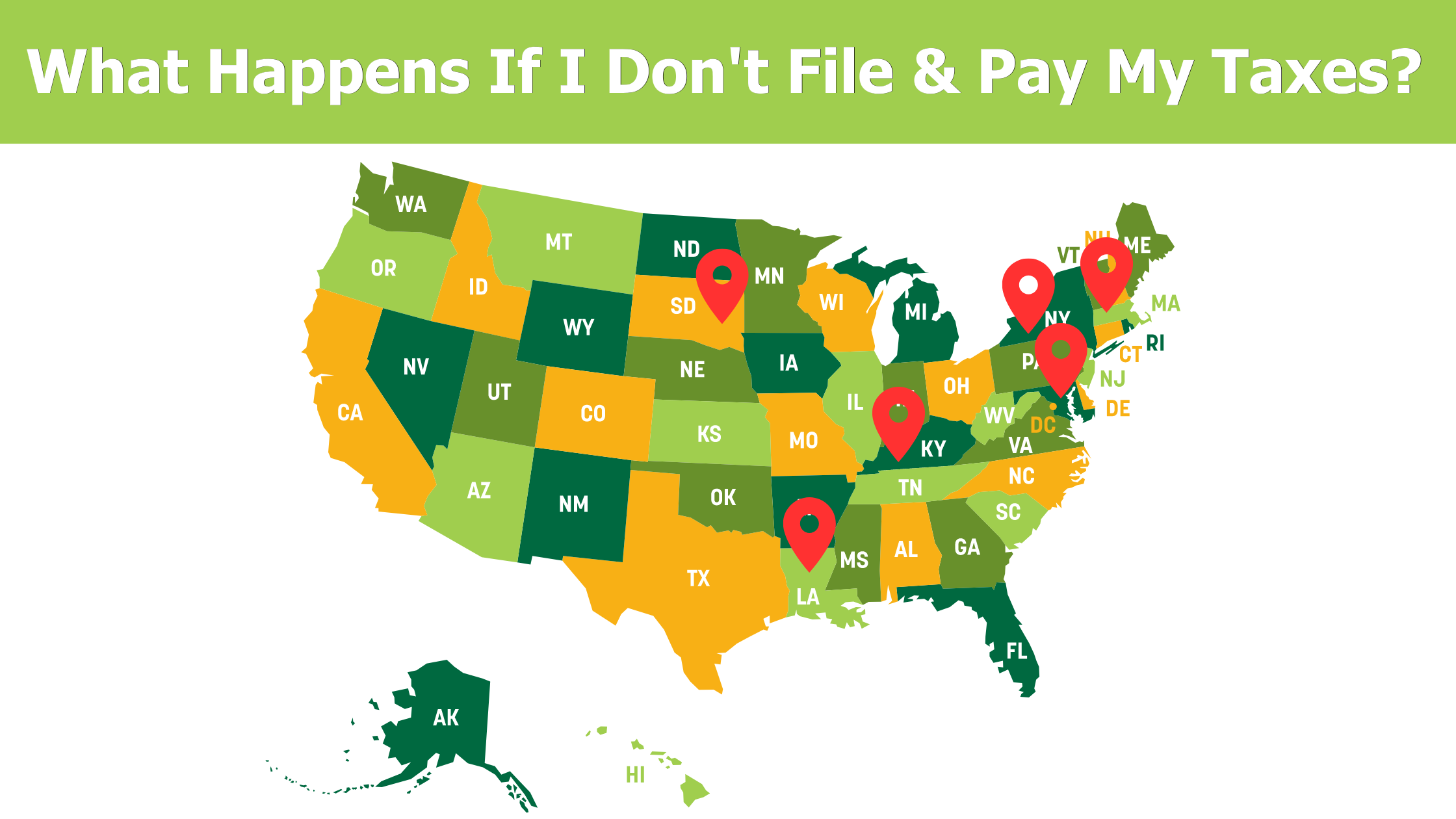

Preserve your right to work! What states can do to prevent you from driving.

If you owe and do not file your taxes, the IRS can garnish your wages and you can LOSE your license to drive.

Abacus CPAs has researched and found that different states have their own laws regarding tax debt amounts and the notification of suspension. Although this isn’t a comprehensive list, we have highlighted some states that can revoke and/or suspend your license for delinquent taxes.

The IRS will also notify the corresponding State Department of any taxpayer with seriously delinquent tax debt. They will also request the State Department of Revenue to do the following: prevent the issuing, deny, and or revoke your Passport. The amount of serious tax debt starts at $59k.

• Maryland: In this state, you might have trouble renewing your driver’s license if you owe taxes and are not in a payment plan.

• Kentucky: Can suspend driver’s license for taxpayers who are 90 days late filing their taxes (including extensions) and have unpaid tax debts that are not in a payment plan.

• New York: Can suspend driver’s license for taxpayers whose tax debt has reached $10k or more, and do not have a payment plan.

• Massachusetts: Can suspend driver’s license for any person who has neglected or refused to file and pay their taxes. A 30-day notice will be sent in the mail, and you will be added to a registration list on the state’s website.

• Louisiana: This state doesn’t mess around! Once you have reached $1,000 in tax debts and are not in a payment plan, you risk getting your driver’s license suspended.

• South Dakota: This state lists unpaid state taxes as one of the offenses that can cause the state to suspend your driver’s license.

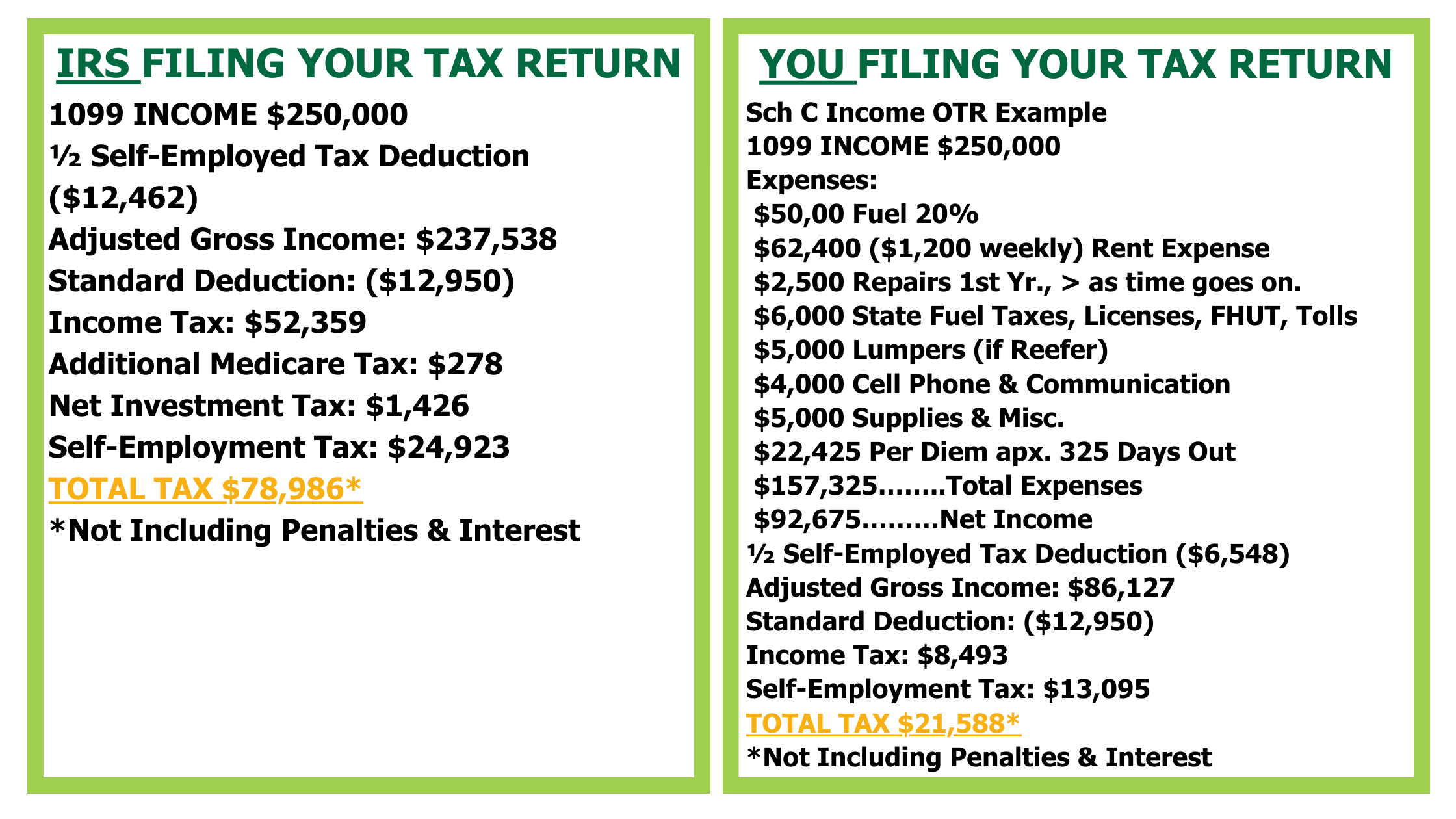

When you do not file taxes, the IRS will file the tax return for you. The IRS will mark you as single with no dependents and will tax 100% of your 1099 pay. You do not get an adjustment for your deductions because the IRS does not have your expenses. Then the IRS will demand payment, and if not paid, may garnish your wages. Remember, the IRS does not have a time limit, so this can happen at any time.

Solution: File your taxes.

If you need more time to file, the IRS automatically grants a 6-month filing extension by filing form 4868 with the IRS by April 15th. File even if you cannot pay in FULL so the IRS does not file a return for you. Below is an EXAMPLE of how a 2022 return was IRS prepared verse you filing your tax return:

If you have any questions, give us a call at 417-380-5000, email us at transportation@abacus.cpa.